China leads while US lags in mobile banking uptake

China is leading the world in the uptake of mobile finance, with 77% of consumers using their phones to conduct financial transactions, according to a global survey carried out by KPMG

Pensacola Tourism: Clean Up Fun

Great attitude, usual for Florida I presume.

Empresa dá prêmio a uma tuiteira que falou bem do seu produto

Unsuspecting Fan Gets Truckload of Wheat Thins – Twitter in action.

Companies Lack Customer Experience Competencies

Only 44% of companies ended up with “very good” or “okay” ratings in the highest performing area, Purposeful Leadership.

3 credit union microsites – the pros and cons

An escaped Rhesus Macaque monkey in Tampa then evaded capture for over a year, traveling across tree tops and through backyards spanning three counties and over 400 square miles. Along the way, the wily monkey accrued a sizable following, becoming a celebrity of sorts, with around 79,000 Facebook fans.

Capitalizing on the media frenzy fueling the monkey’s fandom, GTE Federal Credit Union launched an online “Mystery Monkey Tour Contest.” The contest gave clues to the monkey’s whereabouts via GTE FCU’s Facebook account. The first person to “find” the monkey at four different locations correctly gets a $1,500 cash prize! Anyone who joined during the promotion got a Mystery Monkey of Tampa Bay T-shirt.

Turner Classic Movies – Lose Yourself in Film

I love the colours, and the whole concept of getting lost in the film reels.

Coca-Cola – Machine of Friendship

FLYING DONKEY

Flying donkey… used to promote para sailing…

Nike Woman -Just survive it

Here I am – great, but the whole point of promoted product is getting lost somewhere among the robots, ancient gods, monsters etc… Show your dark side mother nature? Riiiight. It is also way to dark and shady to know what is going on.

You’re all individuals, you’re all different

//Our identity is our key to unlocking the riches of the world or losing them. Our identity is so intrinsic to access and ownership, that it is our most important asset.

Our identity is us.// – good point

Studio total who burns money are being burned by the Arvika festival

I will never understand why do some people believe that all sort of publicity is a good thing.

Dodge: Freedom

Very funny ad. You are just waiting for Mel Gibson to appear somewhere holding a tomahawk. The final message is also fun – freedom, well perhaps, but cars? Geeeez…

Crooks dupe fellow cons into doing their phishing for them

A pair of cybercrooks have posted a phishing kit on hacker forums that lets them steal the data gleaned by those who download and use it

Walmart: Cristoforo Colombo, Galileo Galilei, Isaac Newton

My favourite is the one with Galileo ;-). Very smart series.\

Találd meg a Red Bull E-shotot! part 1 (Find the Red Bull E-shot!)

An interactive YT game, quite funny.

ad Bavaria Beer One Drop of Water Commercial

A man on a mission ;-)

ad The Michelin Man’s a serious badass, whatever he’s trying to say

ad Coffee Heros: Celebrate your heros

I would definitely not put Che on one of these, but it is Germany we are speaking, so I am assuming there is a demand for him there…

Chase Bank’s Second iPhone App: Gift Planner

Symphony of Science

Our Place in the Cosmos

ad Mercedes-Benz G-Class – Fireworks

Bank innovation spend holds up despite weary scepticism

The vast majority of US and UK banking and capital markets firms have continued or increased funding of large innovation initiatives through the financial crisis yet most do not see innovation as a way to rebuild their businesses over the coming years, according to a survey from Accenture.

Holiday Themes: ING Direct Offers Up Anti-Black-Friday Tease

Even B2B marketers are using social media

Channels: Really It’s More Than Just Channels…

Enisa calls for national ID cards to be extended to e-banking

Should we have chip only payment cards?

UK firms ramp up social media spending

The vast majority of UK companies are planning to increase spending on social media in the next year, despite failing to gain real, tangible value from it so far, according to a survey from Econsultancy.

ING Direct Black Friday Screenshots

We don’t need your customer service

The latest report finds that Britons prefer doing their own banking, and would deliberately choose a computer or a mobile phone to manage their finances before phoning a call centre. They don’t want to deal with people in other words – whether in branches or call centres – but want to self-service wherever and whenever possible.

Very quick replacement for a debit card (ING)

Fragmenting the banking structure

ad Stella Artois launches augmented reality Christmas eCard

Kids won’t just laugh off the latest anti-drug PSAs. Or will they?

]]>OK, so let’s start and see where it will take us.

MCDONALD’S ADS TARGET CHILDREN AS YOUNG AS 4

In testimony at yesterday’s one-day food marketing hearing at the Institute of Medicine of the National Academies of Science, a McDonald’s Corp. executive said the company takes Ronald McDonald to elementary schools and is talking to children as young as 4 in its advertising.A McDonald’s spokesman said the company’s “communications to customers including children and moms are responsible and responsive. They are appropriate. They communicate choice and variety. They are age-appropriate, size-appropriate and are [about] a quality meal at a great value,” he said.

…

A McDonald’s spokesman said the company’s “communications to customers including children and moms are responsible and responsive. They are appropriate. They communicate choice and variety. They are age-appropriate, size-appropriate and are [about] a quality meal at a great value,” he said.

Ken Powell, executive vice president of General Foods, said his company markets to mothers, not children.

…

“We strongly think products advertised to kids can be advertised appropriately,” he said. He noted bans on advertising to children abroad and obesity rates that vary widely from region to region in this country, and said that data argues against a link between advertising and obesity.

These guys are serious with their statements… Their attitude reminds me a great movie - Thank You for Smoking

Now This Is How To Advertise Milk – Parmalat Milk Italy

Panasonic nose trimmer: Fatty

Panasonic nose trimmer: Borat

Telenet: Soldier

Telenet: Cyborg

Kudu restaurant: Drive thru since 1988

The inscription – since 1988 is not visible enough. Overall idea is very good.

Fudge: Never too late 1

Vancouver Society of Children’s Centres: 1 2

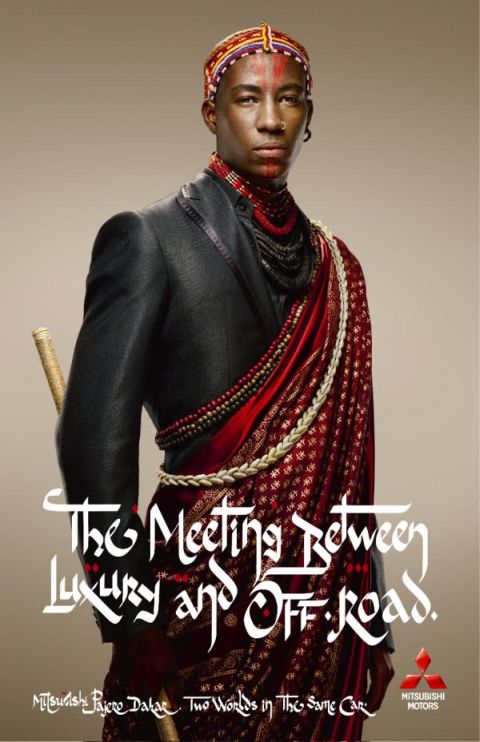

Mitsubishi Pajero Dakar: The meeting between luxury and off-road

From Russia with Love

Russia’s turnaround was best illustrated for me by a friend of mine, who redesigned all the branches for one of Russia’s largest retail banks: Alfa Bank.Alfa Bank a decade ago had these cold, unwelcoming branches. Grey and horrible.Until recently, I thought all of Russia was still like that with queues being the prominent way of life and ‘customer service’ being as likely as transparent goverment.

Wrong.

Here’s the old way of Alfa Bank:

Mashup technologies in real-world banking

Integration with Google Maps is indeed a good idea, I myself have such service from my phone provider – when am checking the history of calls, location of the callers is shown on a map. Of course only for the landlines numbers, identified by the prefixes, but still it is a nice service.

Identifying Multi Channel Customer Experience Best Practice

Orange Israel: Hollywood

Orange Israel: Hollywood

“This clip was shot on an I8910 HD phone, a new camera phone just released by Samsung with an 8 megapixel camera that can actually record and output video in HD format. It was shot in one take, with no post production or special effects of any kind. Everything you see here was done “in-camera”. Our challenge to you is to figure out how we did it. Hint: it’s worth watching in HD…”

I do like such concept, provide a challenge, a competition for your target audience. It was filmed in a really cleaver way.

Turning our streets into neighborhoods – MasterCard

“The Big Lunch, on Sunday 19 July 2009, is a national event designed to break down the walls of anonymity between British people.”

“For one afternoon, every single person will be encouraged to decorate their street, prepare a meal, go outside and interact with their neighbours.”

From the Priceless series. Companies should follow such path, to help not on a nationwide level or for some distant ideas (global warming, give me a break), but show actions HERE and NOW. I’ve been always amazed why do the companies with let’s say large branch network don’t encourage their employees for local activities…

There are no “corporate customers”..

“There are no “private customers” either.. Only human customers in different roles. And they surely deserve to be served with similar tools, logic and language irrespective of the role. Anything else is bad service and slowing up adoption of more productive practises in both roles.”

Using Social Technologies to Run Better Events

The Twitter Book – A Sneak Preview – what the flock Twitter is

Banks – how about focusing on new value?

“But what should banks do now to start to rebuild their scattered images? Back to profitability and basics is for sure one route – simple robust real services – less marketeer driven gimmicks and “products” nobody really understand. But more than that, there is a big area where banks are now needed more than ever before. This is the what we call extended payments services. All the way from potentially doubling the payment volumes by moving into networked sourcing, routing and presenting e-invoices, e-orders, e-confirmations, e-salaries, e-pensions etc to e-id, e-signatures and real time payments – services needed in the networked and increasingly real-time economy.”

An anthropological introduction to YouTube

SIXT WI-FI GUERILLA IDEA

Everything can be an advertising vehicle.

“The anonymous BofA imposter set up his Twitter account yesterday and claimed to be a bona fide staffer at the West Coast bank.

Pros and cons of the ‘new media’. What can you do? Close on them? Then you’ll obsolete.

Will the Troubled Banking Sector Start Pulling Back on Free Consumer Services?

“Free online/mobile banking access: Online and mobile access is an inexpensive service to provide and is likely to remain free for most customers. However, we expect banks and credit unions to begin offering upscale “gold” versions that will carry annual/monthly fees for more benefits.”

This one is easiest to implement and justify I think. Naturally all depends on the market we are acting, so there is no universal solution.

Westpac checks out of Second Life

“Australia’s Westpac has pulled its presence in Second Life and ditched a number of high profile Web 2.0 pilots in response to poor user uptake and changing business conditions.”

No surprise there, as such investments are always first to cut, and it is also not the first example of a financial institution failing in Second Life. As I’ve mentioned earlier on this website – more traditional social networking websites should be targeted in short and mid term. Ultimately Second Life-like communities will prevail. Today also a success could be possible, let’s say some South Korean bank with attractive offer for youth would become the official ‘bank’ for World of Warcraft.

CitiFX Pro goes online and mobile

“CitiFX Pro clients are now able to access their accounts and trade real-time via three state-of-the-art platforms: CitiFX Pro Trader, the current desktop version, CitiFX Pro Web and CitiFX Pro Mobile. Clients with Internet browser access can view streaming prices and charts for over 130 currency pairs and execute trades via CitiFX Pro Web, which can be launched without software installation.”

Brits still failing to protect themselves online – survey

“The average Brit is subscribed to seven internet services, such as internet banking or online shopping sites, and almost a third (30 per cent) of people subscribe to 10 or more. However, almost a fifth of people (18 per cent) use the same password for all their accounts and, of those with 10 or more, 18 per cent use the same password for all of them.”

“Worryingly, the survey also reveals just 12 per cent of people use the recommended secure mix of numbers, capitals and lower case letters when creating their passwords, falling to nine per cent for those in their 60′s and eight per cent for those over 70.”

E-banking draws half of online US population

“49% conducts most, if not all, of their banking via the Internet, up nearly 23% from early 2007.”

“While the research shows 62% of people aged 21 to 34 conduct the majority of their banking via the Internet, around 40% of those aged 45 to 69 are also now mainly managing their finances online.”

Dutch banks bid for customers on online auction site

“To use the Spaarbod site, customers enter the amount of money they want to deposit, for how long and on what terms. The site calculates the best rates and offers the user the chance to sign up.”

Nothing special for now.

“However, they can also choose to have their data sent on to participating banks, which can bid for the business. Within a day the user receives an e-mail listing the five highest bidders and can pick the best offer.

Excellent solution for the Clients who are only seeking the best rate, and are disregarding other factors. Quite dangerous for the financial institutions. When the only thing that matters is a small number and a percentage sign, all marketers efforts are a bit pointless there. There is no place for a shiny brand, exclusive branches, cool ATMs etc. Just the rate.

SmartyPig integrates with money management sites

“SmartyPig is a secure new service that leverages the age-old idea of saving up for purchases before buying, while adding Web 2.0 and social networking technology to reach tech-savvy banking customers. The ability to track SmartyPig goals in online money management sites was a top request from SmartyPig users, who keep an ongoing dialogue with the company through customer service site GetSatisfaction, Twitter, a large fan group on Facebook, and through its popular blog.”

Wesabe launches money management platform for banks

“Aggregation tools enable customers to see all their accounts – checking, savings, credit card and investment – in one place.”

“Furthermore, community features let consumers share advice, support and tips as well as view side-by-side comparison of merchants, showing aggregate spending and satisfaction data, as well as user-generated tips.”

Entropia Universe gets real world banking licence

“The company behind Entropia Universe – an online role-playing game that has a cash economy – has been granted a real world banking licence by Swedish regulators, enabling it to set up a virtual central bank.”

“Mind Bank will also offer selected bank services to customers on the conventional market.”

“It seems obvious to allow time for your employees to connect with their peers across these networks to collaboratively problem solve – though you have to give them the trust to help you innovate and share the reward for it to work.”

“Can banks figure out how to modernise their client services – can they find a way to engage in more transparent dialogue rather than branch-focused workshops with a few customers and expensive budgets that push the brand in other ways?”

“It would be very easy to take a leaf out of the IT service desk approach and evolve the current online banking tools by running a proper Q&A, forum and knowledge base for staff and customers to use and evolve together though there’s not much to banking, is there?”

Banks are just too afraid to be open on the communication with Clients via ‘public’ channels. Let’s name an internet forum. Obviously it’d have to be moderated, so what would happen if a bunch of noisy and unhappy Clients would come? Cut them all off? Community would have been outraged. These are the worries of large universal banks, a fear that a small fraction of Clients (often without particular reason…) will create a mess. In my opinion tools are there to use them, only wisely. Only through communication with those who are leaving money in your establishment you will know how to get your service better.

Fifth Third Bank adds lending information section to site

“The site includes information from the U.S. Department of the Treasury about Fifth Third Bank’s monthly lending data in comparison with other financial institutions participating in the Capital Purchase Program. The site also includes information about Federal Deposit Insurance Corporation coverage and details about how Fifth Third Mortgage Company’s customers can get assistance.”

“Wells Fargo is the latest bank to launch a Twitter feed, where customers can ask questions and seek advice.”

Online banking bill payers are more profitable and loyal – study

“Bank customers who pay bills online are over 15% more profitable and 76% more loyal than those that don’t, according to a study sponsored by Fiserv.”

“In addition customers who paid bills online were 76% less likely to churn or leave the bank, with the figure rising to 95% for people paying five or more a month.”

Arizona State CU launches social media site for recession-hit members

“The HelpingAZ.com site is designed to assist Arizona state and university employees and others who have been impacted by the economy, layoffs and furloughs.”

US m-banking take-up hindered by security and cost concerns – survey

“The poll of over 500 people shows 85% of respondents believe mobile banking is important but they do not want to pay for it. Of those who have not used m-banking, 48% cite security and privacy as the primary reason.”

“The survey also highlights a lack of awareness on mobile banking, with 68% claiming their financial institution does not offer the service.”

Third of European Internet users bank online – comScore

“Of 17 European countries individually analysed, Internet banking usage was highest in the Netherlands, with 52.9% of the total online population using it.”

“France saw the second highest penetration levels, with 49.9% of the total online population, followed by Sweden on 48.4% and the UK, 46.1%.”

Hacking, OTPs and next generation of Authentication Methods

“The following authentication scenarios discussed here apply to a simple connection between a client and his online banking website. After reviewing the most dangerous hacking techniques, we will see what solutions can be implemented.”

Global recession fuels ID fraud fears – Unisys

“According to the poll, 84% of Spanish consumers believe the financial crisis will increase their risk of ID theft and fraud schemes, with 74% of people in the US and 72% in the UK sharing this concern.”

“The survey saw a 10 point increase in Internet security fears worldwide, which included near equal rises in concerns about online banking and shopping as well as computer viruses and spam.”

Wells Fargo calls on customers to switch to online statements for Earth Day

“Pay It Green, an industry alliance organized to promote online banking, including online-only statements, estimates that an average household with online services could save seven pounds of paper, 60 gallons of waste water and five gallons of gas each year. (payitgreen.org/get-the-facts.html)”

Recession-hit Americans turn to Web banking – comScore

“ComScore says nearly 60% of the total US Internet population now visits any one of the top 20 financial institutions’ sites in any give quarter.”

“However, brokerage firms saw their highly satisfied customers decline from 70% of respondents in 2008 to 58% in 2009.”

“Around 37% showed a strong interest in online personal financial management tools, with half of those interested indicating they were willing to pay a modest monthly fee for the services.”

“An instant messaging service would appeal to 30%, widgets to 27% and blogs to 20%.”

It’s a Bird It’s a Plane…It’s Earth Day

“Just one day past Earth Day, e3bank announced their intention to be the first to create a commercially successful, full-service financial institution built from the ground up around principles of sustainability. Which means a bank with no branches but a whole lot of technology.”

Twitter and other banking fads

“According to figures from the Nielsen Wire blog, more than 60% of US Twitter users fail to return the following month. This is actually an improvement on previous 12 months pre-hype stats, when Twitter’s retention rate languished below 30%. Compare this with the 70% retention rates of Facebook and MySpace.”

“Now, I’d assume that each of these institutions has someone whose role is, at least partially, dedicated to servicing that Twitter account. With less than 400 customers to serve, I suppose it is possible, even, that they can create some content which is interesting enough to keep their followers signed up. But what if they had thousands of followers, or tens of thousands? Creating relevance for so many is not likely to be something one person can do.”

“But all of this is irrelevant, really, because the Twitterati aren’t interested in content at all. Their primary interest is counting the number of followers they’ve acquired. It is a badge of honour: you are someone in social media if you have thousands of followers, and noone otherwise. Twitter is a way of keeping score, a means of being part of the “in crowd”.”

“Yes, banks and others need to monitor Twitter. But if that ever became a primary communication channel, something is seriously wrong. I do think that the banks running a help line on Twitter are probably doing a good thing. I monitor a few of these, and I don’t see them getting that much traffic, and what they are doing is redirecting the enquiries, for the most part.”

“Social media have a democratizing effect: it means small voices can more easily be heard. They help balance out the power imbalance of one customer versus a big institution.”

“Relatively few banks offer customers feed services for things like rates. This would appear to be a good application for Twitter. What about campaigns and promotions, announcements of new locations, all that sort of stuff.”

New media uptake threatens retail banking business model – Gartner

“Gartner defines social banking as an emerging approach to retail banking that makes depositing, lending and the connections between depositors, borrowers and financial institutions transparent.”

“Without planning for the emergence of this new financial services environment, retail banks will not only be disintermediated, but also miss a significant opportunity to transform their operations and customer focus, she says.”

Importance of Customer Services during a Crisis

]]>“For a company, Advertisement is your word and Customer Services is your action.

Advertisement is important to let the people know out there that you are still alive and doing ok. Don’t assume that they think you are, tell them. Customer Services are important to do what you say you’re doing. Telling your customers and your potential new customers that you are ok is one thing.”

“Showing them is another one. Show to your customers that they are important to you. Bring them the best quality of service ever, especially during crisis time: Invest in your customers.”

“Banks around the world must take forceful steps to protect their payments businesses or risk a further dent in their profits as the financial crisis continues, according to a new report by the Boston Consulting Group.”

“…global payments revenues hit $805.1 billion in 2008, up from $654.3 billion in 2006, and are forecast to reach $1.4 trillion by 2016 – their momentum is slowing. The darkest cloud over the industry is the steady decline in average revenues per transaction. For banks, BCG estimates that these revenues will fall from $0.94 to $0.88 for domestic payments and from $9.33 to $7.50 for cross-border payments from 2008 through 2016.”

Cornèrcard to add ID and access control applications to contactless credit cards

“Cornèrcard says it will use Transponder technology from Swiss chip card technology outfit Legic to convert the card to a multi-application credential-enabling access control device. This will extend the use of the credit cards beyond pure payments to incorporate access to leisure or club facilities, as an e-ticket for public transport or identification badge for car sharing.”

Citi partners MySpace on reward card

“Citi Forward by MySpace cardholders can earn “ThankYou Points” for completing socially responsible acts, such as donating to food drives, going paperless, switching to energy efficient light bulbs and volunteering.”

“The points can be used for rewards and experiences from MySpace, such as music downloads, VIP concert tickets, private concerts and trips to movie premiere screenings.”

KeyBank launches World Debit MasterCard

“World Debit MasterCard cardholders are eligible for discounts on a variety of products and services, and have access to enhanced customer service and security features. The KeyBank World Debit MasterCard will also feature MasterCard PayPass contactless payment functionality. This offers cardholders increased speed and convenience at the point of sale by allowing them to “Tap & Go”"

The Convenience of Cheques: Long May They Live

Interesting remarks on the cheques convenience. I’ll never get them right, why do people bother with them, but it is only because in Poland we’ve skipped this chapter of financial services. As almost everything after the communism fall had to be built from scratch, CEE banking systems are rather modern, and from start were created to use top solutions of their time. So we’re using payment cards, or e-banking in a greater manner. What I do miss, and frankly do not understand is the fact of small popularity of the gift cards. Oh, well maybe no one tried really hard to sell them.

Barclaycard and Orange team on contactless m-payments

“Barclaycard and Orange will work together on rolling out the technology, which they call “the biggest revolution in payments since plastic cards were introduced over 40 years ago”.”

Stimulus To The Heart – Boss writes to employees

“If any new taxes are levied on me, or my company, my reaction will be swift and simple. I fire you. I fire your co-workers. You can then plead with the government to pay for your mortgage, your 4WD and your child’s future. Frankly, it isn’t my problem anymore.”

Funny, but sad.

Visa pre-paid card load network introduced at MoneyGram locations

“MoneyGram enables consumers with any Visa ReadyLink-enabled prepaid card to add funds – in real-time – anywhere MoneyGram Money Transfer and ExpressPayment are offered. MoneyGram joins more than 8,000 participating Visa ReadyLink locations, further extending the convenience and security of reload services to Visa prepaid cardholders in more convenient, everyday shopping locations.”

Social network hi5 teams with Paymo to accept mobile payments

“Social network hi5 has struck a deal with mobile payments outfit Paymo that will enable members to use their handsets to buy the site’s virtual currency, which can then be used to pay for gifts and content.”

Bank of America ‘online mall’ targets crunched online shoppers

“Bank of America online banking customers with a credit or debit card can register for free through the Add It Up site, entitling them to earn up to 20% cash back on buys at over 270 e-tailers, including iTunes, Walmart, BestBuy and Barnes & Noble.”

Lloyds TSB Commercial Finance introduces pre-paid programme with CredEcard

“Matt Lanford, Head of Prepaid Europe at MasterCard, commented: “More companies are turning to prepaid cards as a safe and convenient alternative to inefficient and costly paper-based payments. Independent research from PSE Consulting suggests that this trend will continue in Europe, with payroll cards estimated to turn over €10.7 billion by 2015.”"

Deutsche Bank embarks on massive m-payments project; hires ABN Amro’s van Wezel

“The bank says the service will allow its GTB clients to offer millions of consumers an instant and secure payments and money transfer service from any mobile device with any network.”

“Deutsche claims it is the first major commercial bank to offer a cross-border mobile payments service to its banking and corporate customers.”

Franklin Bank and Trust chooses DCS card issuance technology

“Utilizing DCS’ technology, Franklin Bank and Trust allows new customers who open a checking account, as well as existing customers who need a replacement debit card, to simply walk into the branch and receive an unembossed personalized card in a matter of minutes. The Visa debit cards are printed and presented to the customer at the time of their visit and can be immediately used when they leave the branch.”

Dutch supermarket fingerprint payments plan shelved

“Dutch supermarket chain Albert Heijn has shelved plans to use fingerprint scanning technology as an alternative to card and cash payments at the check-out after a six month trial failed to dispel security concerns.”

“…intended to test customer reaction ahead of a wider roll out of the technology.”

Idea of convenience is obviously good (you will never forgot or lost such ‘card’ right?), but not in a such implementation. Fingerprinting disregarding privacy issues is equalized with the crime world. It is never a good idea to make your Clients feel like common criminals.

SafPay ships virtual card for online payments

“Virtucard eliminates charge-backs and guarantees all funds to the merchant while providing a safer and more private shopping experience for the consumer. Consumers can shop anonymously at Virtucard merchant stores, as if they were using cash, and prevent personally identifiable information from being disclosed. The benefits to the merchant are significant.”

APS partners Poşta Română on pre-paid card

“The launch of the Poşta Română cashplus prepaid MasterCard opens up a new market by bridging the gap between cash and credit cards in a country where a significant number of its 21 million people do not have a bank account or credit card and most payments are made in cash.”

Travelex unveils Corporate Cash Passport pre-paid MasterCard

“The Corporate Cash Passport easily transfers funds from the cards to company funds and back again any time during the 3-year life-span of the card. The card offers greater control by allowing managers to view exactly how much was spent on given days, watch over employee card funds and keep a check on total expenditure. Card accounts can even be set up with a specific hierarchical structure to better match company loading and management processes.”

Visa selects Malaysia for first commercial contactless m-payments service

“Visa has teamed with Malaysia’s Maybank, wireless carrier Maxis and handset manufacturer Nokia to launch its first commercial contactless mobile payments service.”

RushCard adds budget management tool

“RushCard members report that RushCard’s online suite of money management features is helping them save money. In a recent online survey, more than 79 percent of members agreed that money management tools helped them to stick to their budget. Over half of RushCard members reported that the money management tools already available with their RushCards have helped them save more than $300 annually. Thirty percent said they are saving more than $600 a year.”

Tuxedo launches P2P payment service for cardholders

“Tuxedo Money Solutions has launched the first Person to Person (P2P) payment service in the UK on prepaid cards enabling thousands of users to make instant payments to each other for up to £150 at a time.”

Sony launches contactless payments TV remote

“Viewers can pay online for video-on-demand services using Japan’s EDY and eLIO e-money systems by tapping their cards against the remote controls.”

Levering ATMs for Cardless Money Transfer

]]>“To receive the money, the receiver simply goes to one of the bank’s ATM, and keys in his mobile phone number and the PIN code for the transaction. The information is then verified by the bank system, and if correct, initiates a call to the mobile phone. The customer is asked to accept the call and place the phone in proximity of the ATM’s loud speaker. The ATM then sends an encrypted signal to the mobile phone to authenticate the mobile phone.”

“The service may be proposed to non-bank customers, as even customers without a card or bank account may utilize the service. All you need is cash and a mobile phone.”

There’s a lot of photos and a video how this nice thing works under the above link. Very good idea on an interaction with current and potential Clients, literally any pedestrian. Unique ideas like that always attract attention of the general public. It reminds me described on this website bus-stop-scale (and similar solutions, not yet described ;-)).

There’s a lot of photos and a video how this nice thing works under the above link. Very good idea on an interaction with current and potential Clients, literally any pedestrian. Unique ideas like that always attract attention of the general public. It reminds me described on this website bus-stop-scale (and similar solutions, not yet described ;-)).

This common financial tagline equates to a “life” sentence

“It makes logical sense for a bank or credit union to use this phrase, “…For Life.” It has a nice double meaning. On the one hand, it means, “for everyday living.” On the other, it means, “forever.” Who doesn’t think that feels good?”

Banks do love that word, some good examples of slogans are there.

Credit union gets snarky with ‘greeting card’ for banks

“Coast Capital Savings, a credit union in British Columbia, is asking people to add their signatures and messages to an 8′x10′ greeting card that “congratulates” big banks for the $3 billion in fees that they charge Canadians annually.”

“…is part of a wider campaign from Coast Capital Savings highlighting “ridiculous bank transaction costs.””

“Ads use satirical statements such as “Banking fees are like paying rent on my own money,” and “Banking fees are exciting because you never see them coming.””

“Bushore thinks it’s outrageous that the big banks are charging people fees for the ‘privilege’ of accessing their money. “It’s your money,” he says. “It doesn’t make sense that you have to pay to get at it.””

I do like the ‘I love fees’ (supported by a website) series, like an old man saying: ‘Finding all those fees in my bank statements keeps my mind active., and at my age that’s important’. Videos are placed in the article, ‘Free research’ series is also good.

Miami banker gives $60 million of his own to employees

”After selling a majority stake in Miami-based City National Bancshares last November, all he did was take $60 million of the proceeds — $60 million out of his own pocket — and hand it to his tellers, bookkeepers, clerks, everyone on the payroll. All 399 workers on the staff received bonuses, and he even tracked down 72 former employees so they could share in the windfall.”

What a decent man.

Trend alert: Financial makeover reality contests

”“…savings challenges,” reality-based contests in which selected finalists compete to achieve specific savings and debt reduction goals…”

“…a mix of reality television, online interaction and individual planning to encourage members to reduce debt, increase savings and get control of their financial lives.”

““Layoffs, bankruptcies, foreclosures — it’s all around us. People are afraid and they need help, they need advice, they need someone they can trust,””

“A savings challenge can be a good strategy if you want to build your brand around financial counseling and “advice you can trust.” But if those aren’t part of your strategic plan or components of your core brand, this kind of campaign probably isn’t right for you.”

What times do we live in. People voluntarily are getting rid of their privacy, and all to the glory of the financial institution… Disregarding morals, ethics, and credulousness his is a good concept. Institution is there to help you, and you will feel better in a community of people with similar worries. That’s what the social buzz is all about right now (and will be in predictable future).

PR now completely overshadows ads in financial crisis

”People don’t want to hear what most financial institutions have to say right now…that is, unless they are apologizing.”

““Not many financial institutions are ‘doing,’ most are just ‘saying,’” Stull observed. “Your message needs to be real and show what you are doing.””

“Financial institutions have zero credibility (see the UPDATE in the comments below), so you need a credible messenger if what you want to say is to have any impact.”

Creative Showcase for March 2009

A bunch of nice promotional ideas. BECU ‘Can do’ spot is especially worth recommending:

‘We’re finding ways to help people’

‘Can-DO attitude’

Datahead: Research from around the financial industry

Some really scary figures, like i.e.:

”8% – Percentage of those who feel fully confident in banks,

down from 31% who reported full confidence in 2006.”

or

”35% – Percentage of people who are less likely to trust their bank.”

Ho-ho.

Q&A: An interview about financial branding

”…common branding mistake organizations make is obsessing over the brand’s visual identity. The look-and-feel of an organization is only one small part of an overall brand.”

“…assuming that it’s their “service” that differentiates them. When I ask a financial institution what differentiates them, 9 times out of 10 they’ll say, “It’s our service.” If everyone is saying the same thing, then (1) it isn’t helping differentiate anyone, and (2) in all likelihood, many of them are lying.”

“It’s the same problem with mission statements, and why everyone’s reads exactly the same: “Our mission is to be the premier provider of quality financial solutions by earning people’s trust in the most friendly and professional manner possible.” Scratch out the common clichés and what are you left with? Not much.”

“A good place to start is to get rid of any pictures of shiny, happy people in your marketing materials. I’ve got drawers full of brochures from banks across North America that are brimming with lifestyle photos. Avoid these like the plague and you’re well on your way to creating a distinct brand identity.”

I do not want to copy all of it here, so I do really recommend visiting the link. Creating a distinct brand identity should be the ultimate goal of all financial institutions. Services, procedures, rates etc. that all can be copied, but our IDENTITY defines who we are. This is the one thing that ca not be copied – not only because strict copyright/intellectual property laws, but because of people who create it.

Barclays has fun with ‘Water Slides’

Description of the Barclays campaign, to which I made some remarks here.

Banks and Credit Unions on Twitter

”Participating in Twitter is a low-cost entry into social media that can actually help save a customer relationship or three. Compared to blogging, it is much less labor intensive. It’s also less of a marketing platform given the 140-character limit in posts.”

I must getting old, as the Twitter hype really bypasses me, but I do see its potential. Also, it s rather serious business, as some might pay for it 700 000 000 $… It reminds me the $15 billion Facebook evaluation some time ago, but never mind that. If something is free to use, and give an opportunity to contact with your Clients, it would be a shame not to use it. But in the other hand, being too much wide open for communication is not a good idea in times of crisis. ABA Banking Journal deals with some issues here.

” The objective of a bank blog may be to educate customers about financial topics, or provide the institution’s perspective on current events. Blogs could, however, morph into advertisements, intentionally or unintentionally. A blog-turned-advertisement is subject to all of the advertising compliance rules.”

” Here are 13 tips and things to consider when picking an ad agency partner for your financial institution.”

“2. “Funny” Does Not Always Mean “Money”

Don’t fall in love with an ad agency just because they show you a bunch of funny spots. Just because a campaign is funny doesn’t mean it got any results. It’s always easier to make funny ads than ads that really work. An agency’s portfolio could be full of humor without ever having one piece that was on-strategy and achieved the intended results.”

Rescued dog stars in FAB&T kids marketing program

”This account had a huge dollar bill (named “Buck”) for a mascot. The idea was that every time a child made a deposit, they would receive some trinket — pencil, crayons, activity sheet, etc. The problem was that branches would run out of items to give to kids, or the kids would wind up receiving the same item over and over again. How many times can getting a pencil be fun, right?”

“They soon realized they had a new financial superhero to replace FAB&T’s “Buck.” They wanted a dog. After all, dogs personify many of the bank’s values: loyalty, compassion, trust.”

“When kids open an account, they receive a plush Cash dog and a card that is stamped at each subsequent deposit. After the appropriate number of deposits, their card can be redeemed for an item.”

“The hope is to create a ‘Happy Meal’ type of excitement,”

I like the idea of card stamped during every deposit. Kids love to collect such stuff, maybe they should’ve evolve the concept into more-like Pokemon style ;-). That’s a joke, but if you’re planning to deal with kids, it is always good to have a fluffy animal mascot around.

ING stacks your finances against peers

”A new, free web-tool from ING, INGCompareMe.com, uses peer data to let people see where they stand on a wide range financial matters including savings, spending, investing, debt and planning.”

It is always a good idea to give people an opportunity to compare themselves with other people anonymously. It is said, that people want to be special. I disagree, in terms of financial issues they do want to follow the crowd, they want to be average, as thanks to that they feel safe. This tool gives them an opportunity to do so.

The myths, facts and hardcore realities of social media marketing for financial institutions

What’s on TV? Ads for financial institutions

A collection of TV spots, I believe the ‘St. George Bank – “Lullaby”’ is the best one

”A huge crowd of St. George Bank employees gathers outside an average Australian man’s house as he retires for bed. They hum him a lullaby. The announcer explains, “At St. George, every single one of us is working to make sure that the things that keep you up at night no longer do.” The man sleeps blissfully.”

LEED gold branch for a true-green credit union

”To meet strict LEED standards, 75% of construction waste must be diverted from landfills. Builders must carefully separate scrap metal, wood and concrete for transport to certified recyclers in the nearby area. Construction sites must also be contained to protect drainage systems from soil runoff. Builders and subcontractors have to review material lists to ensure supplies contain the right percentage of post-consumer recycled content. For example, the recycled metals that makes up the siding on the Washougal branch may have come from recycled soda cans or automobiles.”

Green mania strikes again.

Yes Bank to identify you at the door

”The next time you visit a bank branch and the relationship manager addresses you by your name even before you could introduce yourself, do not be surprised. It’s not that the executive remembers your face; it’s the technology that transmits relevant customer information to relationship managers when a customer enters the branch.”

“The technology allows for personal identification of customers at the branch by inserting an RFID microchip into their debit cards.”

“…only two customers out of 100 enter a bank branch to buy…”

It’s been a part of a branch of the future concept for a long time, the only concern is how it and similar solutions will inflict into Clients privacy. What is their acceptance level? Client is not interested in a benefit for the bank, he always asks what are the benefits for him, so unless such privacy invading solutions will be properly supported by improvements in convenience/quality of services, I see a misty future for them.

More proof that PR overpowers financial ads

”The truth is that people are hyper-sensitive to news about financial institutions right now. They are tuned-in. Whereas they may have never noticed an ad from their financial institution(s) before, they now pay attention with keen interest. “What are they saying?” This applies to all media, marketing and communications channels — not just advertising.”

AIG Corporate Security’s Tips for Surviving an Angry Mob

I do especially like this one: ‘Avoid wearing any AIG apparel (bags, shirts, umbrella, etc.) with the company insignia’

Series of articles about WaMu-Chase merger, not a positive tone, but notice new channels influence on communication:

Why Chase is killing WaMu’s retail concept (a very good concept by the way)

How the Chase/WaMu merger is playing out on Twitter

The post-WaMu blues: Chase has lost ‘that lovin’ feeling’

“All of the materials used in the construction are either recycled or highly sustainable materials. The building also makes use of low-water use landscape plants and a gray-water system for irrigation.”

“All regular tellers serve both lobby and drive up members via live video feeds. The drive up is a stacked design to allow for faster service and less idling time.”

“Employees have formed a Green Team, which examines ways to make daily work at MFCU more efficient and environmentally responsible.”

The last one is especially interesting. It’s not important whether that initiative was their own, or they were strongly suggested to do so, the image counts – our employees care.

Missoula Federal Credit Union

Marketing makeovers for tough times

“…here are some highlights for marketing to young adults:

Anchorage: Consumers of all ages are looking for balance and security. This is in the same vein as the “nesting” that was so popular after 9/11. Here, however, Getty sees popular searches like “balance,” leading to images of yoga, spas and balancing rocks. “Fun,” the most popular search word five years ago, has given way to “dream,” still aspirational, but slightly more serious.

Guru Joe: Corporate execs are out; relatable experts are in. Getty sees a move toward personas and faces that are believable, empathetic and “quietly aspirational.” A parallel trend is in raw visuals—essentially well-framed snapshots that connote a company’s authenticity.

Women: Not just a target but a symbol. Fully 36% of advertising tearsheets surveyed featured single women, while only 5% featured single men. This could be further proof that both women and men enjoy seeing women, but guys don’t catch each others’ eyes. Getty says, “Women are coming to represent in a wider way ideas of collaboration and cooperation. The age of the single white male hero is taking a cultural time out.” That’s not good news for this white male, but I’ll roll with it.”

It’s always hard to get to the young people. Interesting point, with greater highlight putted on ‘dream’ than fun. More mature? Hardly, maybe more realistic. I do agree that financial institutions should use more of the so-called ‘independent’ experts and professionals to gain credibility.

Is Saving a Game of Chance? Nope.

”…Save to Win just launched at eight Michigan credit unions* in a pilot project testing consumer response to prize-linked savings.”

“…credit union members compete for monthly and grand prizes by making deposits into one-year, federally-insured certificate accounts. At the end of the pilot, one fortunate credit union member will take home the $100,000 grand prize. Others will share in just under $40,000 in monthly cash prizes.”

“…account holders earn an entry with each $25 deposit, up to ten entries per month. One emergency withdrawal is allowed during the certificate’s term, but if the depositor closes the account, all entries disappear.”

“The state’s economy is even worse off than the rest of the country, increasing consumers’ need for savings.”

“Save to Win aligns perfectly with the credit union mantra, people helping people, and this is what sets credit unions apart from other financial providers.”

“For many consumers, the need to save gets short shrift when good intentions meet unexpected expenses.”

““Perhaps the lack of savings in America can be attributed to the fact that savings is simply not fun, and the motivation to save has been stripped away,” observes Denise Gabel, chief innovation officer at the Filene Research Institute. “What kinds of motivation are financial institutions providing to consumers?” Interest is posted in nickels and dimes, and consumers often don’t perceive tangible rewards from saving money.”

“Prized-link savings programs use the thrill of the chance to win a meaningful prize to encourage the development of regular savings habits and the accumulation of wealth, especially among lower-income households.”

““One of the biggest tests that remains to be seen about prize-linked savings – … – is whether it will inspire non-savers to start saving.””

“In researching prize-linked savings programs, he’s observed how the appeal of gambling can be channeled into a desire to accumulate savings. People often overestimate their chances in low-probability events, Dr. Tufano says, which explains why playing the lottery has become a popular, yet ineffective, investment strategy. In all probability, money spent on lottery tickets will be entirely lost. With Save to Win, funds remain intact, federally insured, and earning interest, even if the depositor fails to win a prize.“

Banks are well familiar with promoting their products with a lottery system. It’s impossible to say in definitive matters whether it is good or bad solution. When properly designed, it can become beneficial, but it can be as well a waste of money. I’m a supporter of the solution based on fewer prizes, but of the greater value. Clients will not decide to choose us, only because we’ll give them a calendar, bag or an umbrella when making i.e. a deposit. What really matters is the opportunity to win the BIG prize.

I must agree that in terms of communication as stated above, Clients often don’t perceive interest as they should. That’s why a strategy of showing examples exists, like we’ll rather promote a deposit with yearly interest of 5% by i.e. ‘on every 10 000 deposited in our institution, you’ll earn 500’. There are ways to sell it in a more attractive way.

Virtual Finance and CU Island: In it for the long haul

I’ve also been once excited with the whole Second Life in finance industry deal, but examples which I’ve seen were having a rather minor success. Still, the virtual reality is a platform of communication with a great potential, but for now I believe it will evolve into interaction on the level of social networking websites.

10 Financial Commandments for Your 20s

Finally, financial literacy that’s effective AND fun

“The game is called Celebrity Calamity, and it gets through tricky subjects like universal default and introductory APRs, while forcing you, the manager of a budding ingenue’s finances, to make quick choices between buying what they want and keeping them out of debt.”

“The game needed to be effective and fun to overcome the perception that personal finance education can be difficult, scary, and boring. The preliminary results from experience and efficacy testing show:

50-70% improvement in financial knowledge

15-30% confidence increase in key areas”

I do like the concept, and its cartoonish style, but I’ve mixed feelings about the deep and quality of this education. Still, I prefer the way how traditional banks educate, i.e. with a partnership with schools. But yes, this can be boring ;-).Doorways to Dreams (D2D) Fund

Q&A: Youth marketing for financial institutions

“I don’t see anyone helping kids and teens deal with financial peer pressure. I think this should be a standard part of any financial literacy outreach program.”

“a fantastic documentary on HBO a few months ago called Kids + Money that illustrates the role money plays in the lives of young people. After I viewed it, all I could think about was the immense pressure kids and teens have to spend money on clothes and the next “cool thing.” In many instances, a teen will spend hundreds of dollars needlessly on things like purses and shoes, just so they won’t be ostracized at their school”

“…if you offer a youth section on your website, don’t lump the kids club with the teen club. Teens don’t want to be associated with kids…”

“…companies trying too hard to be cool and cutting edge.”

” I constantly hear things like, “my mom opened my account,” or “my dad had an account at the bank, so I opened an account there.” Targeting parents must be at the forefront of any youth marketing initiative.”

“we never market financial products to kids under 13 years old. For kids under 13, it should be about education.”

“…hen dealing with the youth market: fun and humor. Although kids and teens love money, learning about financial concepts can be a bit dry. ”

“…kids retain more information when it’s delivered through storytelling.”

Quite a lot of interesting points out there, mostly ok. The idea of targeting parents in the youth initiatives is a real eye opener. It’s true, that in most cases, especially when we are not interest in the subject, are not researching by ourselves, we go for an advice to our close ones. Young people are financially dependant on their parents, so their opinion is crucial. That’s why the ‘family’ accounts should have a significant place in the bank offer.

I do not see how a financial institution could help kids to deal with the social pressure to be trendy. It’s not their job. The only thing they can do is to learn kids to manage their finances, but this will not eliminate the need to become a Paris Hilton lookalike. We can create a habit of saving, but other issues should be solved by the parents or school. Subcat Marketing

How Can Online Banking Develop its Own Black Card?

“But we continue to believe that financial institutions are missing a revenue opportunity to provide premium fee-based services to certain segments.”

“If American Express can command $2500 per year for its black Centurion Card and Barclays $495 per year (see note 1) for its slightly more pedestrian Black Card launched in December (see note 2), why can’t banks get $10/mo for a similar premium version of online and mobile banking? The short answer: They haven’t tried“

It’s true, that online banking is immediately associated with the low profile services for the masses. One of the reasons is that when you’re having a traditional ‘marble’ bank, it is easy to segment Clients, separate affluent from the rest, make them feel special (leather couches, greater space, separate entries etc.). But when it comes to the basic online banking, we all are equal. Can a rich person browse faster the online banking service? I do not think so.

Online banking was and will be a way to reduce costs of service. Additionally on the early stage marketers chosen this channel to sell services to the price-aware Clients, so onlynie banking become a synonym of cheapness. You have to act carefully, as it is really easy to create an internal competition for your services. Selling premium services there is a challenges, as the Client got used that here he can got things cheaper than at branch, or for free. You may say, we can make him feel special by adding a bunch of additional features, or extend the traditional ones. This may work, but as well it may only confuse him. I’d love to read more on this subject.

Eye-tracking studies: more than meets the eye

“Our User Experience Research team has found that people evaluate the search results page so quickly that they make most of their decisions unconsciously. To help us get some insight into this split-second decision-making process, we use eye-tracking equipment in our usability labs. This lets us see how our study participants scan the search results page, and is the next best thing to actually being able to read their minds. Of course, eye-tracking does not really tell us what they are thinking, but it gives us a good idea of which parts of the page they are thinking about.”

“The heatmap below shows the activity of 34 usability study participants scanning a typical Google results page. The darker the pattern, the more time they spent looking at that part of the page.”

Such perception was created by the websites designs standards/trends. I just wonder if it applies only to the ‘Latin” world, or is it also true in countries like Israel where the right to left scripting method is used.

]]>